July 7, 2023

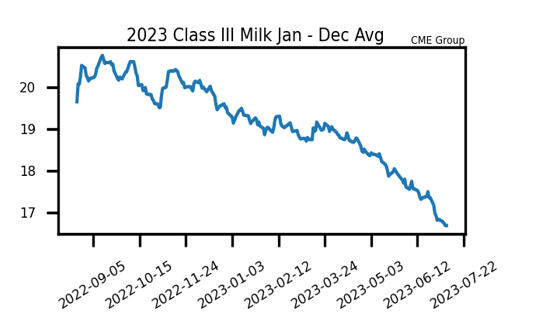

Milk and Spot Markets Mixed

- Spot cheese found plenty of buyers this week and the active purchasing worked prices higher in 3/4 trading days this week.

- Spot butter remains the darling of the spot markets and finished at $2.48/lb after Friday’s trade, a high price for 2023.

- The Dairy Products report yesterday showed butter and whey production higher, while total cheese production and powder was lower, on a year-over-year basis for May.

- US dairy cow culling for the week ending June 24th, up 11.1% from the same week last year.

The dairy markets were mixed on Friday, with nearby Class III and IV contracts higher to unchanged, while spot markets were both up and down. August futures for Class III were higher by 15 cents per CWT, while September and October futures found gains of 1 cent and 8 cents, respectively. Class IV futures for those same months were unchanged, while both classes found slight losses throughout the remainder of 2023. While the green on the board Friday was a welcome sight for milk prices, the overall averages for Q3 and Q4 in both classes were still down overall on the week. Spot markets were mixed as well with cheese and butter higher, while powder and whey were lower and the same results were had on the week overall. The spot cheese price found gains in 3 of the 4 trading days, finished over 4.5 cents higher per pound, and a whopping 105 loads traded on the week overall. Butter was decently traded with 21 loads moving this week pushing prices up to $2.48/lb, a 2023 high. Powder and whey continue to drag lower, with powder prices at their lowest since early in 2021 and whey prices still at an all-time low. The price movement of whey lines up with overall production and inventory levels above the 5-year average and 2022 numbers.

Corn Futures Sideways

- After last week’s massive sell off on corn futures, mid-week price hikes were contributed to short covering, and Friday’s action wiped away the mid-week gains.

- The front month corn contract has fallen from near $6.75 per bushel on 6/21 to today’s close of $4.8725/bu.

- Favorable forecasts are predicted for the Corn Belt throughout the next week, but rains will be limited for northern states adding to already dry conditions.

- Crop ratings have turned around on the back of recent rains as the good-to-excellent rose one percentage.

- Year-over-year corn usage for ethanol was down 9.1 million bushels in May, a 2% drop. To hit USDA estimates, an increase of over 7% is needed for the remainder of the crop year.

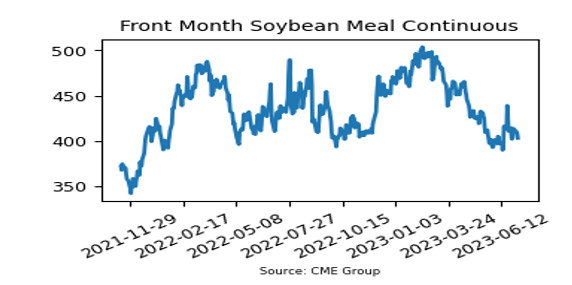

Meal Prices Riding Roller Coaster

- Price action on the front month meal contract has been volatile since mid-June, seeing prices at $386.5 climb to $441.20, fall to $389.50, climb back to $433.70, and settle today at $402.80.

- Crop ratings showing a slight decline over the last week did not stop the soy complex from falling in this week’s trade.

- It was reported that Brazil was busy selling beans to make room for the large safrinha crop that is 20% harvested currently.

- May crush sets new record as US processors worked through 189.3 million bushels of soybeans, up 2.3 million bushels from April and up 8.4 million bushels from last May.

Friday’s Market Quotes