February 28, 2023

Generally speaking, you have rather limited choices when prices fall. You can either sell your grain or wait for prices to rebound. And let’s face it – it feels pretty bad to sell when prices are down, only to see prices rise once again. On top of that, most people suffer from recency bias; they assume prices will continue rising as they have been, making it easy to wait. However, it really could be worse. You could wait for prices to turn around, only to see prices plummet.

So, what are you supposed to do? How do you tell if a downward change in price is just another price fluctuation on an existing upmarket (sit tight!) or the start of a change in trend (sell!)? This is what makes marketing so difficult – the market can give you hints of what could happen, but you really don’t know what will happen. Luckily, there are some strategies that can help you capitalize on market potential while protecting you from market downsides. With that in mind, let’s focus on Stop Loss orders, commonly referred to as “Stop orders” or “Stops”.

How a Stop Works Conceptually

A Stop is an order with a set quantity that is filled in the future if and when the market trades at a level you set, called the Stop price. You can place a Stop order for both a market trending up and a market trending down (or even sideways). If you place a buy stop order and the market hits a Stop price ABOVE the market, your Stop will trigger a purchase. If you place a sell stop order and the market hits a Stop price BELOW the market, your Stop will trigger a sale. You set the Stop price, you set the quantity, and you retain the ability to make changes to the order (such as changing the Stop price and quantity) on unfilled orders.

Stops can allow you to follow a trending market more safely by providing a safety net in the event of a trend change. This means you can feel confident making sales closer to a market high or buying calls closer to a low. However, like all marketing tools, Stops can be at best ineffective and at most dangerous if not employed strategically with discipline and consistency. With that in mind, let’s review some important safety tips.

Important Considerations for Setting up an Effective Stop Strategy

1. Choose your Stop price with care.

Typically, the orders are placed below what is perceived as market support and/or above what is perceived as market resistance. This is subjective, based on the analysis and rationale of the person setting the Stop price.

The predominant thought behind support and resistance levels is that, if the market penetrates those levels in any meaningful way (for instance, by closing above support or below resistance), the market has a strong tendency to continue in the same direction. In other words, this may indicate a change in trend. (FYI, the TFM360 recommendations utilize the market close to determine if a Stop price has been triggered.)

2. Make sure your Stop price reflects market changes.

To follow a market trend more safely, adjust your Stop price with the market. Move it higher as the market moves higher, and lower as the market moves lower. If you do move Stop prices to reflect market changes in your favor, consider incrementally larger order sizes to potentially capture the better price on more of your production.

3. Layer Stops incrementally.

As you move up (or down) a trend, you may make a sale, only to see the market rebound to another high. However, if you set successive Stops consistently in incremental quantities of production, you should move more of your production closer to the market top and to a better average price overall.

4. Execute your Stop if and when it’s triggered.

Remember that you set up your Stop to protect price in a potentially falling market, so it’s important to pull the trigger and execute a Stop order. If/when a below-the-market Stop loss order is triggered (i.e., a Sell Stop), you should make a cash or forward sale, enter an HTA, or have the Stop order working in the futures market to initiate a hedge automatically. Check with your grain buyer— sometimes they will hold a Stop Loss order to initiate a sale or an HTA for you. When using an above-the-market Buy Stop order, you should consider using the trigger to buy call options, remove a hedge and buy puts, or remove a hedge entirely—assuming you are confident that the market will rise in your favor.

5. Continue to employ your targets to make sales.

As target prices are hit and the sales made, simply cancel the Stop(s), or reduce the quantity of the Stop accordingly, so not to double up on any sales.

Let’s take a look at how this type of strategy works.

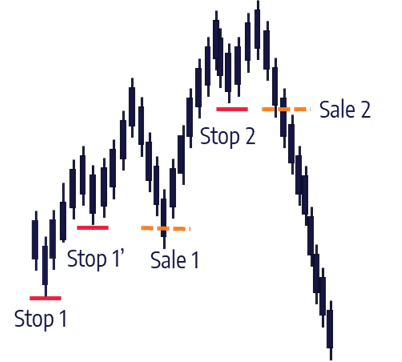

The illustration below represents the top of a market that has enjoyed an upward trend and is showing signs of softening. A farmer (let’s call him John), wants to take advantage of the rising market. He is concerned he might wait too long and end up selling in a down market. He decides to employ a stop strategy to help him make sales closer and closer to the top.

He places a Stop order on a portion of his production and sets a stop price at what appears to be a support level (Stop 1 on the illustration). As the market rises, another support level seems to appear, so John adjusts the stop price on the order, shown as Stop 1’.

As John debates whether to make a sale on a still-rising market, the market falls and touches the stop price of Stop 1’, triggering Sale 1 at the market price.

Fortunately, the market rises again with a new support level at a higher price than the old support level. John places another Stop Order (Stop 2) at this new support level with a larger quantity to take advantage of the higher prices. The market continues to rise, then falls precipitously. The market touches the stop price for Stop2, triggering Sale 2.

In combination, the two sales John made allowed him to track the market safely, while taking advantage of prices close to the market high.

Some questions about the strategy:

1. Was Sale 1 a Mistake? John made Sale 1 on a down market and prices then rose. Did the strategy fail? No—remember that the goal is to improve average price by making sales closer to the top. However, the key to success is to place subsequent Stop(s) with higher Stop prices to help ensure future sales are even closer to the top.

2. What if John had not adjusted the Stop price for Stop 1? · He would have triggered a sale on a smaller proportion of his production at a price close to the original, much lower Stop price, also leaving a greater proportion of his production at risk of falling prices.

3. What if John had not set a Stop at all? It’s hard to say, but setting stops ensured he had a sound strategy to pull the trigger and was able to make sales before the market fell too much.

An Example of a Below-Market Stop in an Up Market

The years 2013 and 2014 were rather heady when it came to corn prices. And, as with all markets, the end of a long bull market was unclear. After such a long bull market, some of you may recall that many farmers found it hard to believe that prices would ever fall again in any meaningful way. Emotionally, it was hard to make a sale with the hope that the market would continue even higher. This was a moment when unemotional strategic planning using Sell Stops really benefited the farmers who utilized them.

In the chart below, note the end of the bull market through 2014. In March, if a farmer had set and executed on a Stop first at 474, and then another one at 435, they would have sold increments of production at prices still near the top of the rally. By setting those orders, they would have resisted the temptation of waiting for the market to return to levels that weren’t achieved again for years.

Use Stops to Take the Emotion out of Marketing

At TFM360, we talk a lot about taking the emotion out of the market. This message is especially pertinent as we move further into a mature bull market. It’s unclear when the market will end, and still, it is clear that it will end. As a result, use tools that help you plan your price protection in advance, and that help you move as close as you can to the top of the market without falling off the cliff.

The advantage of Stops is that they’re flexible, cost-effective, and designed to help you make decisions in advance without the emotions of the market getting in the way.

Prepare to Take Action

As you think about your strategy, we’re here to help you make a plan that can both protect you and help you capitalize on the volatility in the market.

If you have any questions about market conditions, how to plan for different market scenarios, or anything related to the price you’re building for your crop, please contact your advisor or the Total Farm Marketing team at 800.334.9779.

©February 2023. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices may have already factored in the seasonal aspects of supply and demand. The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Reproduction of this information without prior written permission is prohibited. This material has been prepared by a sales or trading employee or agent of Total Farm Marketing and is, or is in the nature of, a solicitation. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing refers to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with any of the three companies. Total Farm Marketing is an equal opportunity provider.