Whether you’re a grain producer or feed purchaser, you know how important it is to build the best price you can, using a rather limited set of pricing tools. The riskiest approach is taking the market price – who knows where the market will be in the future? Alternatively, you can buy a futures contract or forward contract to lock in current prices on future sales. If you’re a seller, you can also store grain in the hopes you won’t need to sell it until prices are better.

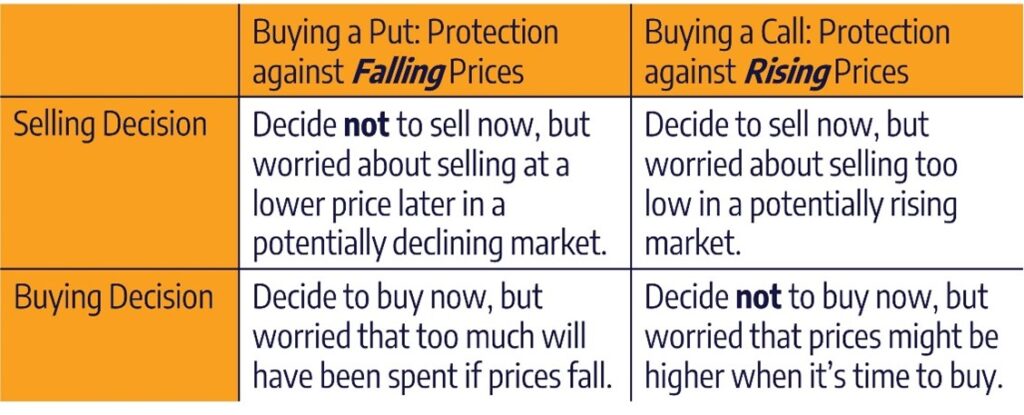

Of all the possibilities – alone or in combination – along with some cash products through an elevator, only the purchase of put and call options allow you the potential to unwind some of the negative impact of a sale or purchase decision you make today on your bottom line. Think of put and call options as insurance to save you from thinking later, “I should have acted” or “I should have waited.”

Deciding whether to purchase a put or a call has a lot to do with (1) whether you decide to purchase or sell grain now or to wait until later, and (2) where you want price protection. Let’s take a look at a variety of scenarios to see how this plays out.

Scenario 1: Protecting the Price of Unsold Grain Using Put Options

In our first scenario, you’re a farmer who grows corn. You know that the price of corn can be volatile and unpredictable, and you want to protect yourself against a potential drop in price. You decide to leave your grain unsold and purchase a put option.

A “put option” is a contract that gives the buyer the right (not the obligation) to sell a certain amount of corn at a specific price (called the “strike price”) on or before a certain date in the future. The buyer pays a fee (called the “premium”) plus a commission for the right to sell corn at the strike price.

In our example, the current price of corn is $6 per bushel, and you’re worried that the price might drop in the next few months. You purchase a put option to cover all your production with a strike price of $5 per bushel, which would give you the right to sell your corn at $5 per bushel if the price drops below that level.

If the price of corn does drops below $5 per bushel, say to $4.50, you can exercise your put option and sell your corn at a net higher price of $5 per bushel less the premium and commission. If the price stays above $5 per bushel, the good news is that the price of corn didn’t collapse, and maybe even increased. In this case, you don’t have to exercise your option and you’ll only lose the premium and commission you paid for the option.

Scenario 2: Protecting the Price of Sold Grain Using Call Options

In our second scenario, you’re that same farmer, and you decide to sell your corn at the current market price of $6. While you think the price is good, you are worried that prices might go up and that you’ll lose out to potentially higher prices. In this case, you decide to purchase a call option to protect your price.

A “call option” is a contract that gives the buyer the right (not the obligation) to purchase a certain amount of corn at a specific price (called the “strike price”) on or before a certain date in the future. The buyer pays a fee (called the “premium”) plus a commission for the right to buy corn at the strike price.

Assume again that the current price of corn is $6 per bushel. You purchase a call option on all your grain with a strike price of $7 per bushel, which would give you the right to buy back your corn at $7 per bushel if the price rises above that level.

If it does, you can exercise your call option and “buy back” your corn at the higher price of $7 per bushel, and then resell it for any price above $7.00 and pocket the difference between the first sale and the resale, less the premium and commission. If the price stays below $7.00 per bushel, it means that you sold at a good price – and maybe even better than the market price. You don’t have to exercise your option and you’ll only lose the premium and commission you paid for the option.

Scenario 3: Protecting the Price of Purchased Corn Feed Using Put Options

In this scenario, you’re a cattle feeder that uses corn as feed for your cattle. You’re of a mind that prices have likely gotten near the bottom and decide to purchase feed for upcoming months. Nonetheless, there is some softening in the market that has you worried you might see prices drop again, and may end up paying more than your competitors for feed. In order to protect yourself, you decide to purchase a put option (the right to sell) to protect yourself from declining prices on all your purchased corn.

The current price of corn is at $6 per bushel. Much like the producer who fears he might be waiting too long to sell his grain, you purchase a put option with a strike price of $5 per bushel, which would give you the right to sell corn at $5 per bushel if the price goes below that level.

If the price of corn does decrease below $5 per bushel, say to $4.50, you can exercise your put option to sell your purchased corn at $5 and repurchase it for $4.50 plus the premium and commission you paid for the option. If the price stays above $5 per bushel, you paid a reasonable price for your feed given market conditions. In this case, you don’t have to exercise your option and you’ll only lose the premium and commission you paid for the option.

Scenario 4: Protecting the Price of Unpurchased Corn Feed Using Call Options

Finally, assume that you’re that same cattle feeder that uses corn as feed for your cattle. You’re worried that the price of corn might increase in the next few months, which could hurt your profitability. You’ve decided not to pre-pay for future corn purchases, and instead protect yourself against the risk of rising prices by purchasing a call option on all your anticipated feed needs.

Again, the current price of corn is at $6 per bushel. Much like the producer who feared he sold too early, you purchase a call option with a strike price of $7 per bushel, which would give you the right to buy corn at $7 per bushel if the price goes above that level.

If the price of corn does increase above $7 per bushel, say to $7.50, you can exercise your call option and buy corn at the lower price of $7 per bushel plus the premium and commission you paid for the option. If the price stays below $7 per bushel, the market price remains reasonable; you don’t have to exercise your option and you’ll only lose the premium and commission you paid for the option.

The Best Marketing Decisions Are Thoughtful Decisions

Options give producers and purchasers alike the right to buy or sell corn at a specific price, which can help protect against price fluctuations. As with all market tools, however, pay attention to how they work. More specifically,

- You have to pay a premium and commission for this protection, and you need to do the math to make sure that the price you pay for that option is worth the potential reward if exercised, especially over the time frame of the options contract.

- You don’t buy insurance against risks that are unlikely to happen. Keep that in mind as you think about the protection you are buying. It’s not clear in which direction the market is going. Think twice about buying protection when the potential for upward or downward momentum is minimal.

- Just as we recommend making incremental purchases and sales, think about incremental option purchases. Coverage for an entire crop or feedlot is quite expensive. Instead, think about making targeted option purchases that fit into a broader strategy.

For almost 40 years, Stewart-Peterson Inc has helped producers like you make smart, thoughtful decisions about their marketing. We focus on the math of our recommendations to help make sure that the strategies you employ can make a discernable difference on your bottom line.

©July 2023. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency and an equal opportunity provider. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. A customer may have relationships with all three companies. TFM360 is a service of Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC.